ct sales tax exemption form

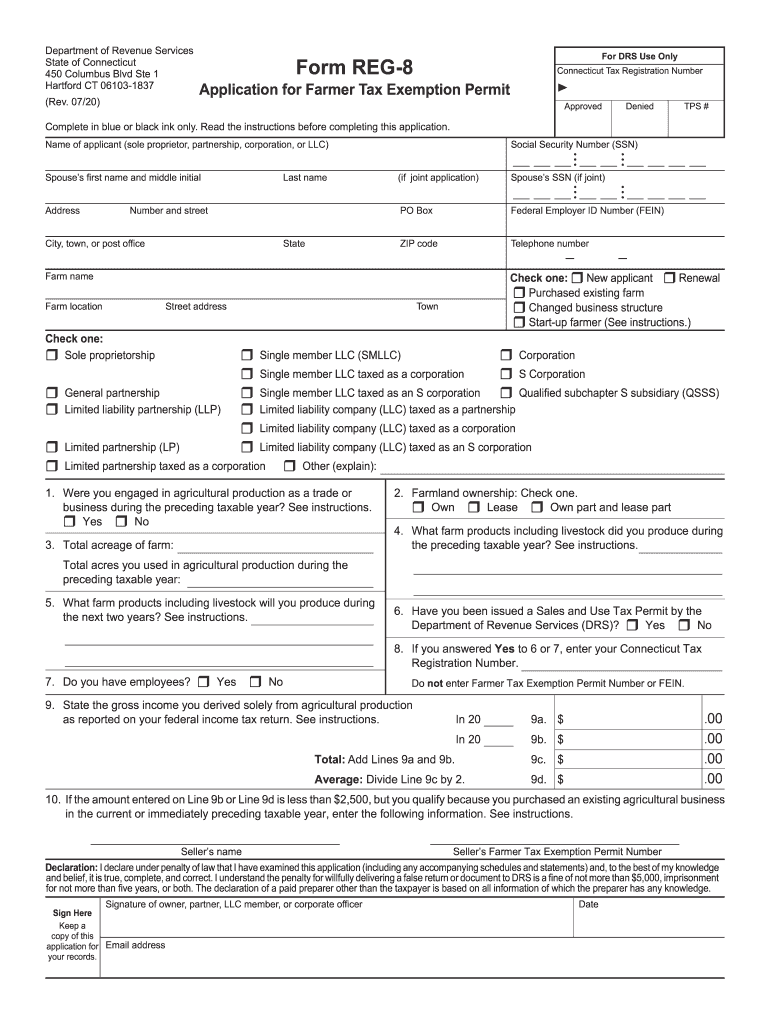

If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued. Dear Sir You are requested to provide the updated sales tax exemption certificate for your bill.

Connecticut S Sales Tax On Cars

Ad New State Sales Tax Registration.

. Rental Surcharge Annual Report. Sales of and the storage use or other consumption of firearm safety devices. Fillable Form Ct 20 Communications Sales And Use Tax Certifcate Of is a free printable for you.

This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. Page 1 of 1 Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. For example an exemption permit issued in 2014 is valid.

For more information see Tax Bulletins How to Apply for. This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. Ih yqw hcxg ceeguu vq c TTY.

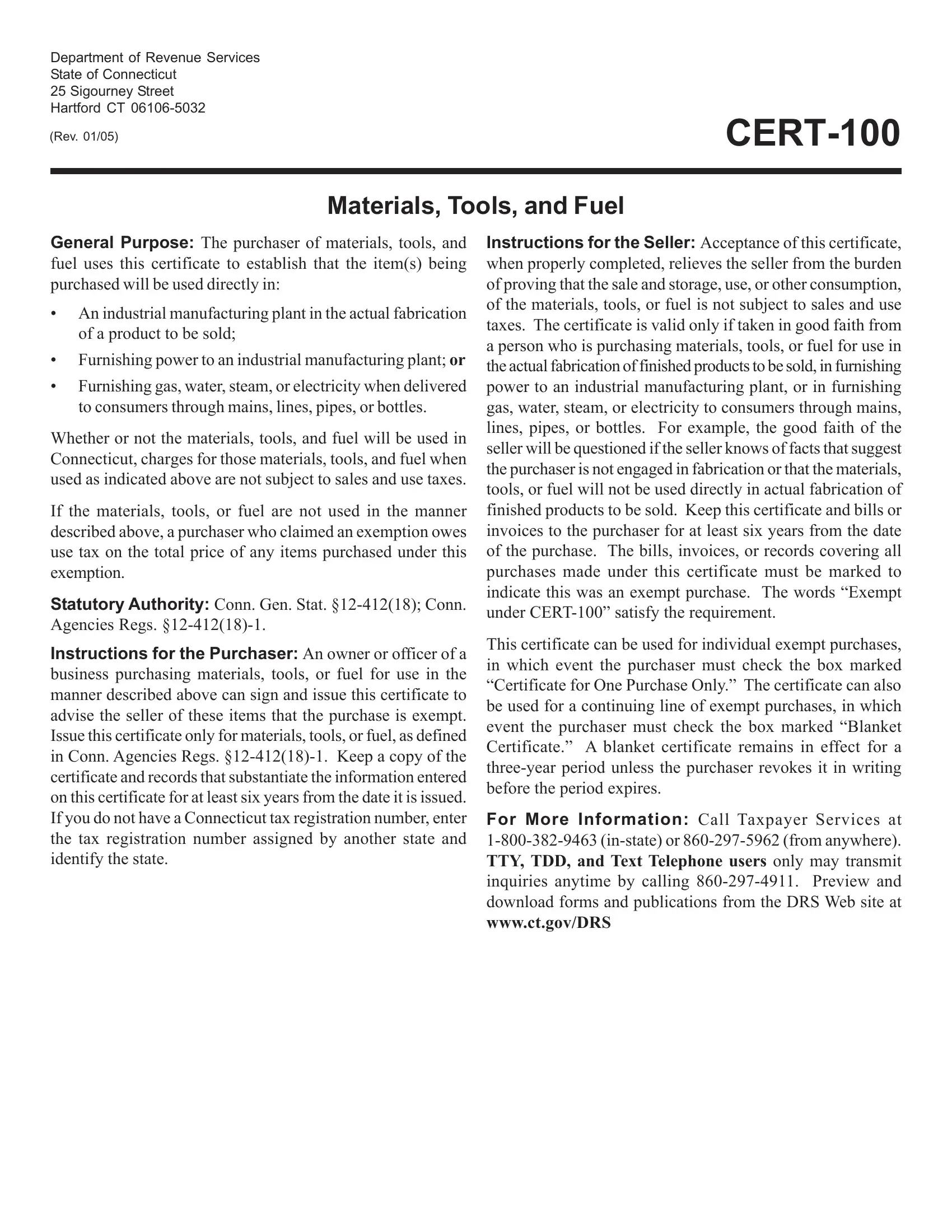

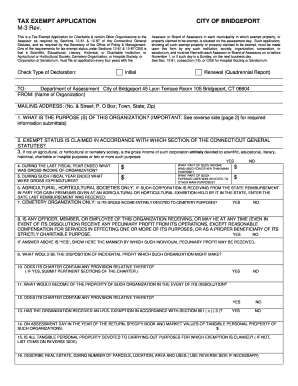

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. Easily Customize and eSign Your Documents Online with SignNow. Printable Connecticut Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations Form CERT-119 for making sales tax free purchases in Connecticut.

Connecticut Innovators CI can act as a conduit for a sales and use tax exemption for the companys anticipated qualifying capital equipment andor construction materials. Hawaii has a general excise tax that is different from the typical sales tax of other states. Sales tax exempt exemption of state sales tax form.

Dry Cleaning Establishment Form. Ad Register and Subscribe Now to work on your NY DTF Form CT-247 more fillable forms. Factors determining effective date thereof.

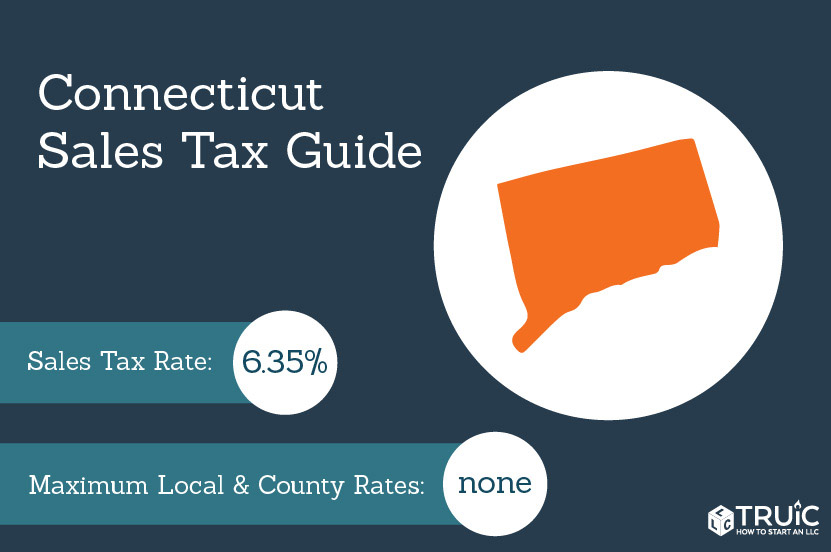

Ct Tax Exempt Certificate information registration support. SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

The following is a list of items that are exempt from Connecticut sales and use taxes. An organization that was issued a federal Determination Letter of. Easily Customize and eSign Your Documents Online with SignNow.

Elevate your beauty routine with rocelec. Exemption from sales tax for items purchased with federal food stamp coupons. You may apply for a refund of the sales tax using Form AU-11 Application for Credit or Refund of Sales or Use Tax.

Ad Customize and eSign duties for the Connecticut non exempt. Ad Customize and eSign duties for the Connecticut non exempt. SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need.

Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption. What is Exempt From Sales Tax In Connecticut. General Sales Tax Exemption Certificate.

How to use sales tax exemption certificates in Connecticut. Health Care Provider User Fees. Page 1 of 1.

Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods. Exemption from sales tax for services. Connecticut Tax Exemption for Meals Lodging PDF 187 MB Back.

Sample Letter Requesting Sales Tax Exemption Certificate from Customer. Other Connecticut Sales Tax Certificates. Exemption permits must be renewed every two years.

There are exceptions to the 635 sales and use tax rate for certain goods and services. This page discusses various sales tax exemptions in. Top 60 Ct Tax Exempt Form Templates Free To Download In PDF Format is a free printable for you.

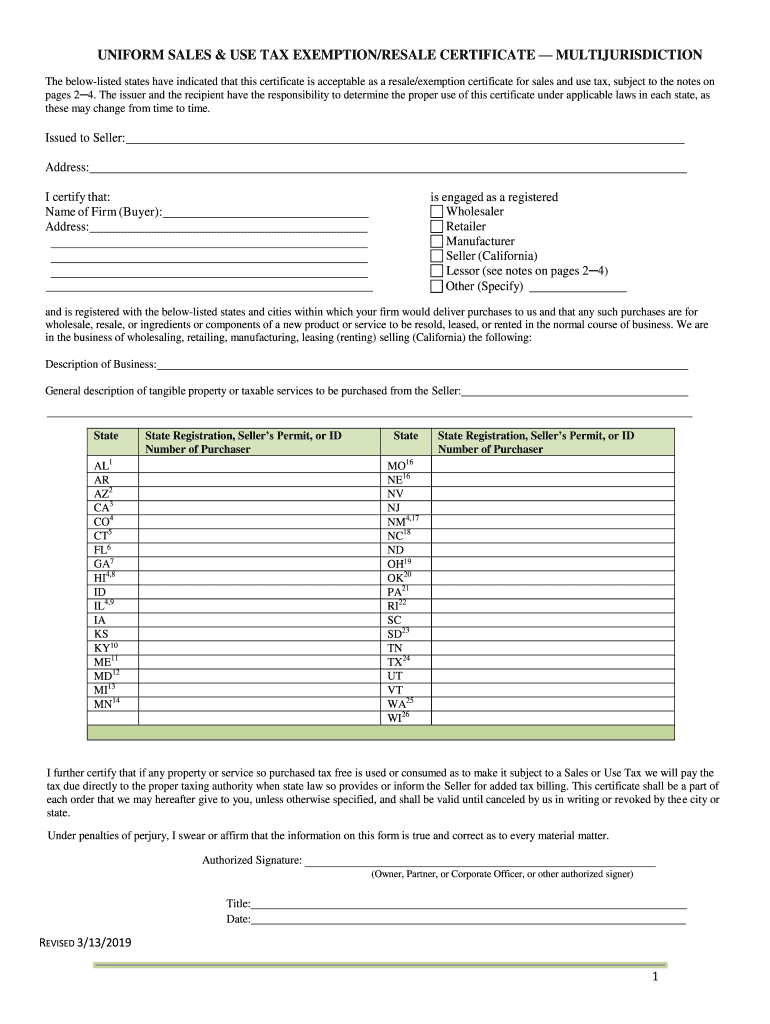

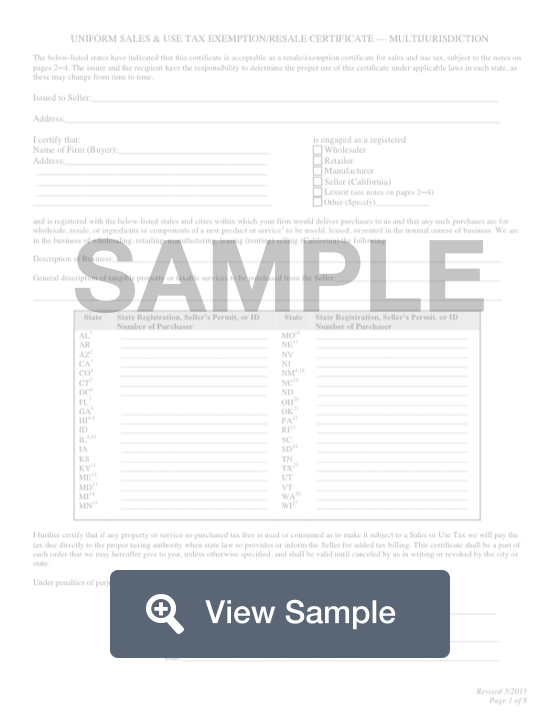

Services Subject to Sales Use Tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. This is not a complete list of exemptions but it does include purchases commonly made by individual.

Ad Find out if you qualify for tax-exempt status. 7 on certain luxury motor vehicles jewelry clothing and footwear.

What Is A Sales Tax Exemption Certificate And How Do I Get One

2019 Tax Certificate Fill Out Sign Online Dochub

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Download Business Forms Premier1supplies

Connecticut Sales Tax Small Business Guide Truic

Ct Cert 100 Form Fill Out Printable Pdf Forms Online

Sales Tax Exemption For Building Materials Used In State Construction Projects

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Form Cert 126 Fillable Exempt Purchases Of Tangible Personal Property For Low And Moderate Income Housing Facilities

Tax Certificate Upload Peerless Electronics Inc

Ct Reg 8 2020 2022 Fill Out Tax Template Online Us Legal Forms

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

King Soopers Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com